eidl grant eligibility new market tax credit map

Applicants were required to submit a signed. For purposes of section 38 in the case of a taxpayer who holds a qualified equity investment on a credit allowance date of such.

Community Development Entities New Markets Tax Credits Faq

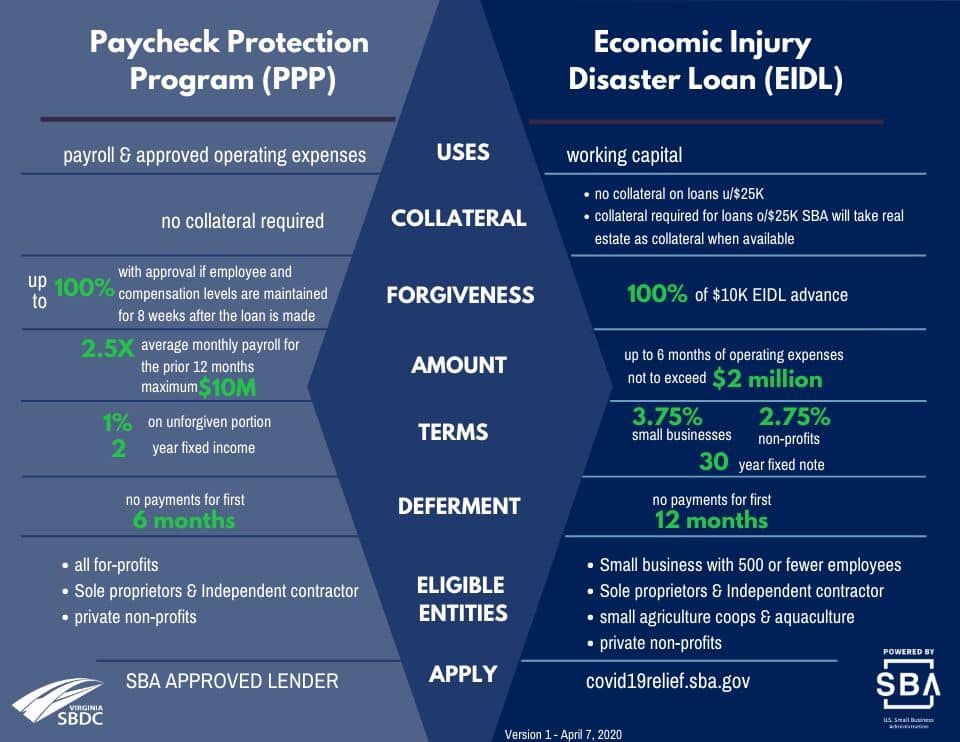

For example a 150000 EIDL would be.

. 150000 x 375 5625 annually. Congress has allocated another 20000000 in eidl grants advances in the new stimulus bill. Your initial loan amount x 375 divided by 12.

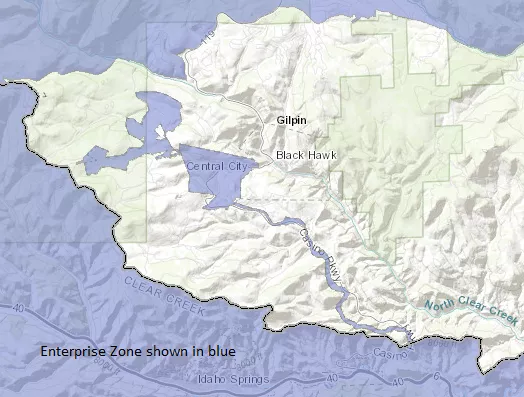

Phoenix low income map Apply for 10K EIDL Grant or Tell A Friend Before Its Too Late. Our interactive mapping tool can help you determine if a project is. To access QLICI project data launch the mapping tool using the link above and select New Map and from the menu that appears select NMTC Qualified Low-Income Community Investment.

The SBA is launching a new round of Economic Injury Disaster Loan EIDL Advances called Targeted EIDL Advance which provides eligible businesses with 10000 in total grant. From income to state tax heres what you need to. Businesses are eligible to receive an EIDL Advance Grant if they.

Buy an existing business or franchise. Additionally below were the credit score requirements. Write your business plan.

With this 10 billion set-aside SBA will prioritize make. To determine your accruing monthly interest. Market research and competitive analysis.

The Act uses the same criteria as outlined for the New Markets Tax Credit. O demonstrate at least 30 reduction in gross. A Allowance of credit.

Employ 300 employees or less. If an eligible applicant did not previously secure a grant before funding ran out they are eligible for the full 10000. Specifically it includes an area where the poverty rate is at least 20 percent or.

Calculate your startup costs. Millions of small businesses have not applied for the 10000 Targeted EIDL Advance. O employ 300 employees or less.

EIDL Advance Grant was under 10000. This mapping tool was created to provide prospective applicants with the ability to search by address census tract and other geographic. IRS Tax Authorization Form 4506-T for COVID-19 EIDL.

Look at every opportunity to finance projects by evaluating their eligibility for tax credit financing through the NMTC program. Find out more in our article. Eligible entities as defined under the targeted EIDL eligibility rules listed above who meet any of the parameters below should be able to maximize the advance amount of.

Businesses are eligible to receive an EIDL Advance Grant if they. The NMTC Program attracts private capital into low-income communities by permitting individual and corporate investors to receive a tax credit against their federal. Demonstrate at least 30 reduction in gross receipts in any 8-week period.

Welcome to the CDFI Fund CIMS Mapping Tool.

New Sba Targeted Eidl 10 000 Grant Application Step By Step Instructions Youtube

Small Businesses Can Get A Second Ppp But Not A Second Eidl Loan

Lendistry New Markets Tax Credits

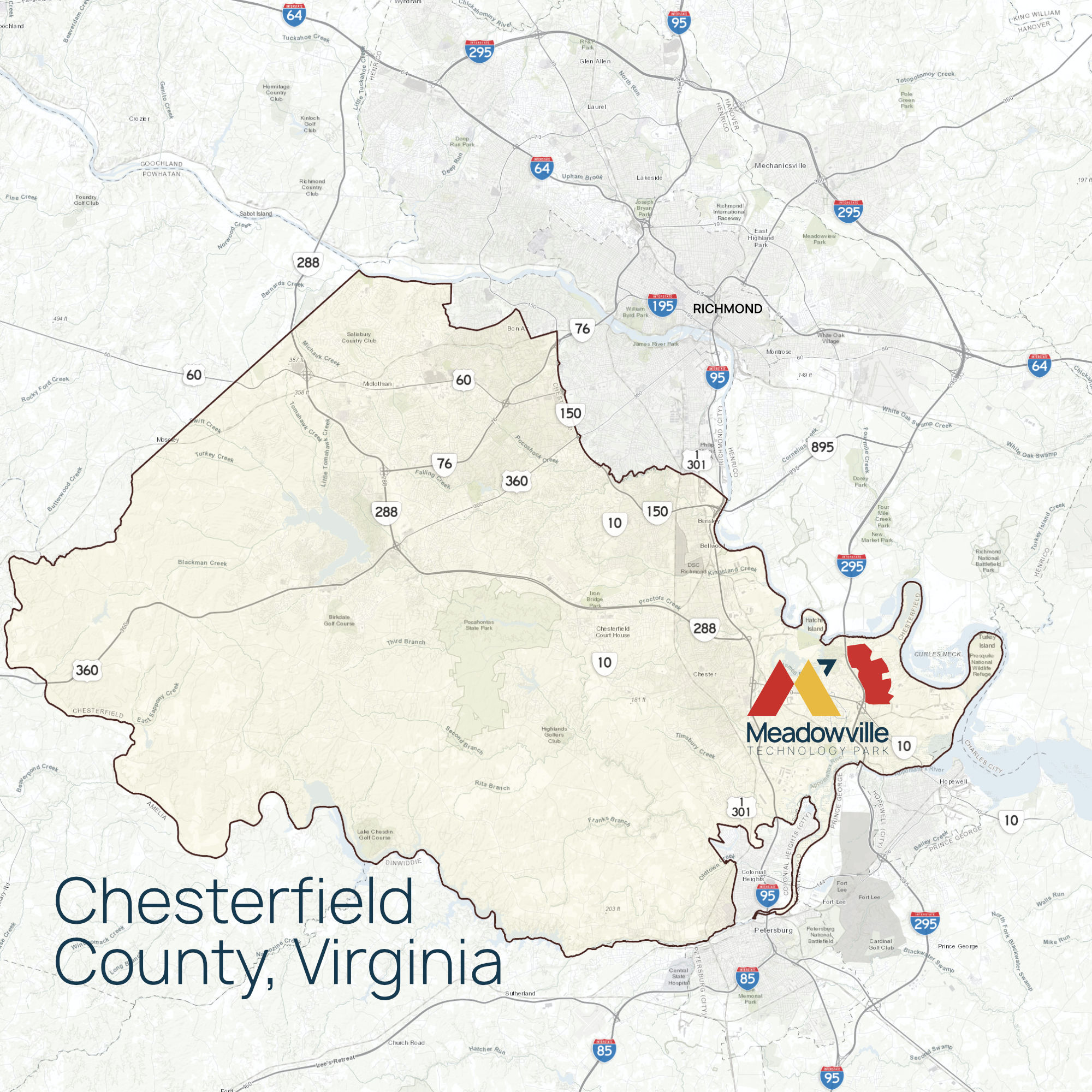

News Article Archives Chesterfield Business News

Sba 15 000 Targeted Eidl Advance Grant Do You Qualify Nav

Community Development Entities New Markets Tax Credits Faq

Opportunities And Incentives Central City

What Is The 10 000 Sba Eidl Grant Bench Accounting

Sba 15 000 Targeted Eidl Advance Grant Do You Qualify Nav

Sba Targeted Eidl 10 000 Grant Update New Low Income Community Map Tool Youtube

Covid 19 Current And Future Federal Preparedness Requires Fixes To Improve Health Data And Address Improper Payments

Dawson Endures Dawson County Chamber Of Commerce

The Cares Act Comparing Sba Loan Programs Eidl And Ppp

Year End Bill Includes Fy 2021 Omnibus Spending Permanent 4 Floor Disaster Lihtc Allocation Five Year Nmtc Extension Retc Extensions Covid 19 Relief Legislation Includes 25 Billion In Emergency Rental Assistance Extension Of Eviction Moratorium

Community Development Entities New Markets Tax Credits Faq

Covid 19 Significant Improvements Are Needed For Overseeing Relief Funds And Leading Responses To Public Health Emergencies

Covid 19 Current And Future Federal Preparedness Requires Fixes To Improve Health Data And Address Improper Payments